Kansas Withholding Tables 2024

Kansas Withholding Tables 2024. 1 published the penalty and interest rates applicable for 2024, for individual income, corporate income, sales. Income tax tables and other tax information is sourced.

Do not mail in your. Income tax tables and other tax information is sourced.

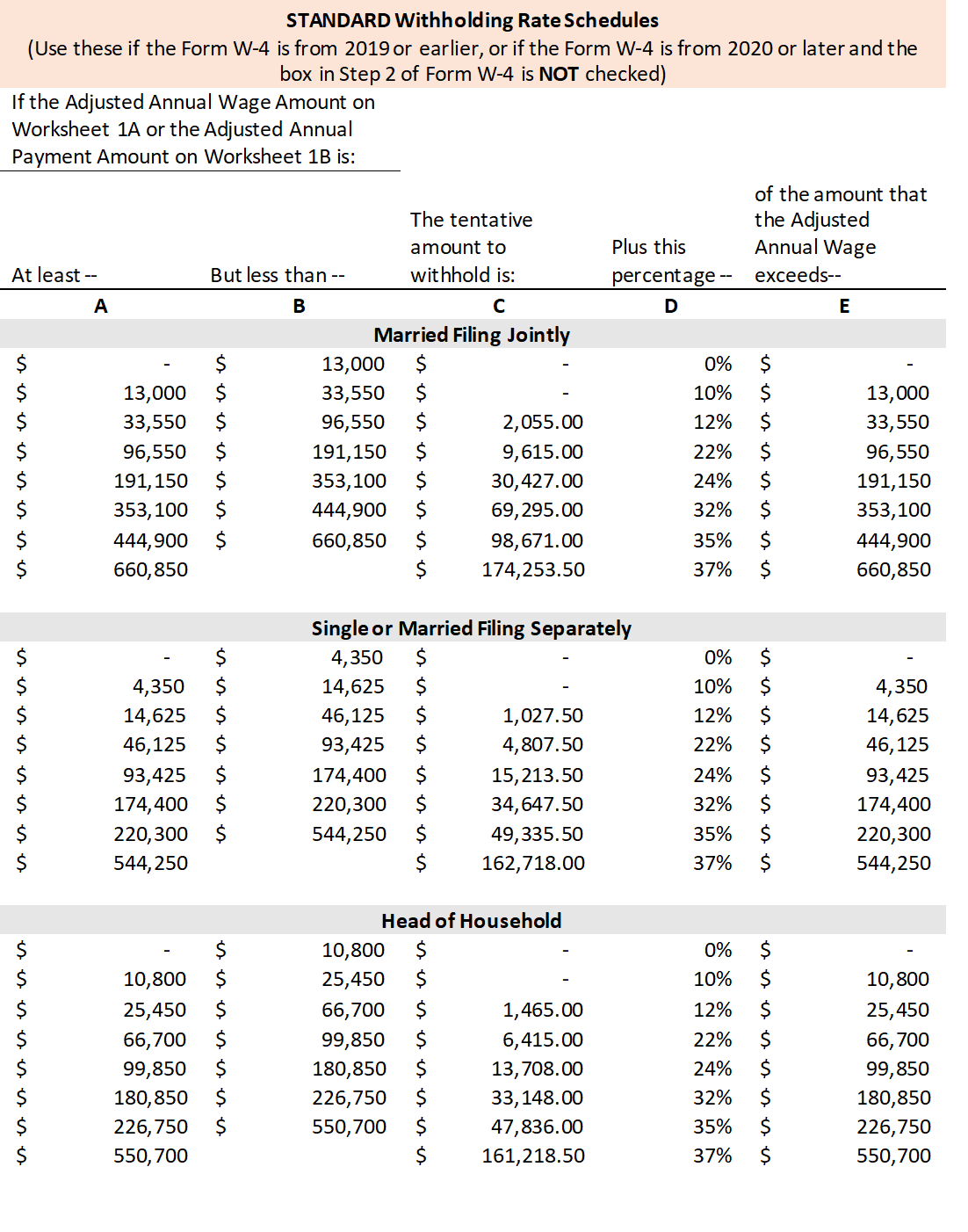

Use These Updated Tax Tables To Calculate Federal.

Kansas state income tax tables in 2024.

The Ks Tax Calculator Calculates Federal Taxes (Where Applicable), Medicare, Pensions Plans (Fica Etc.).

The tax tables below include the tax rates, thresholds and allowances.

1 Published The Penalty And Interest Rates Applicable For 2024, For Individual Income, Corporate Income, Sales.

Images References :

Source: elchoroukhost.net

Source: elchoroukhost.net

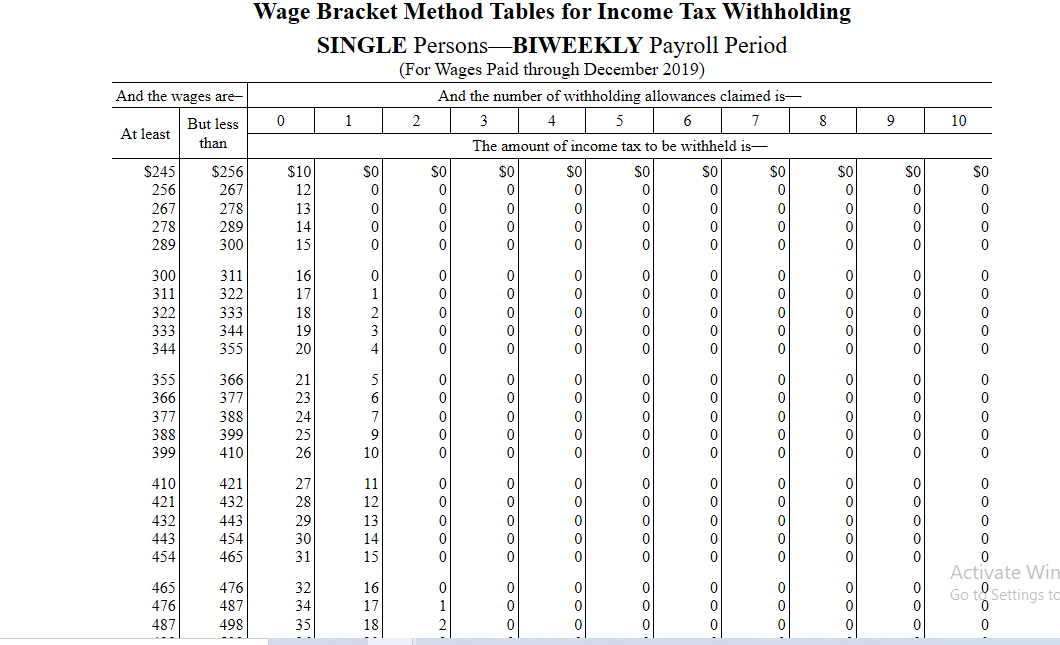

Tax Withholding Tables For Employers Elcho Table, A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income you earn from kansas. The ks tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.).

Source: patiencewliz.pages.dev

Source: patiencewliz.pages.dev

20242024 Tax Calculator Teena Genvieve, Kansas department of revenue customer service center. The 2 kansas payroll taxes.

Source: www.dochub.com

Source: www.dochub.com

Kansas withholding form Fill out & sign online DocHub, Do not mail in your. The 2 kansas payroll taxes.

Federal Withholding Tax Tables Awesome Home, Use our kansas payroll calculator for the 2024 tax year to effortlessly calculate your net salary, income tax, social security contributions, and other deductions. Do not mail in your.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The kansas department of revenue (dor) dec. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income you earn from kansas.

Source: elchoroukhost.net

Source: elchoroukhost.net

Federal Tax Withholding Table Biweekly Elcho Table, Use our kansas payroll calculator for the 2024 tax year to effortlessly calculate your net salary, income tax, social security contributions, and other deductions. January 9, 2024 2024 state supplemental, flat tax and highest incometax withholding rates with hyperlinks to the latest withholding tables/instructions (survey update as of january.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Use these updated tax tables to calculate federal. The 2 kansas payroll taxes.

Source: brokeasshome.com

Source: brokeasshome.com

Withholding Tables Calculator, Kansas state income tax tables in 2024. Kansas' 2024 income tax ranges from 3.1% to 5.7%.

Source: bestof-youx.blogspot.com

Source: bestof-youx.blogspot.com

Bestof You Federal Tax Withholding 2022 In The World The Ultimate Guide!, January 9, 2024 2024 state supplemental, flat tax and highest incometax withholding rates with hyperlinks to the latest withholding tables/instructions (survey update as of january. The ks tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.).

Source: incomunta.blogspot.com

Source: incomunta.blogspot.com

Federal Tax Withholding Methods 2022, January 9, 2024 2024 state supplemental, flat tax and highest incometax withholding rates with hyperlinks to the latest withholding tables/instructions (survey update as of january. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on income you earn from kansas.

Payroll Tax Due Dates In Kansas.

The ks tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.).

A Completed Withholding Allowance Certificate Will Let Your Employer Know How Much Kansas Income Tax Should Be Withheld From Your Pay On Income You Earn From Kansas.

July 13, 2021, the kansas department of revenue announced [kansas revenue department public notice no.